High-Frequency Trading (HFT) is a complex yet intriguing area of modern finance that has come to play a significant role in today's markets. Leveraging cutting-edge technology, HFT involves the execution of a large number of trades at extremely high speeds, often in mere fractions of a second. These transactions, carried out by sophisticated algorithms, can influence the landscape of the financial world, affecting pricing, liquidity, and market dynamics. This guide aims to shed light on the intricate workings of HFT, exploring its evolution, its impact on markets, and the controversies surrounding its practice. With a thorough understanding of HFT, one can better comprehend the rapid, algorithm-driven movements that make up the heartbeat of the global financial market.

Definition and History of High-Frequency Trading

HFT can be described as a trading strategy that uses advanced technology to execute a large number of orders at high speeds, with the goal of profiting from small price discrepancies. This form of trading emerged in the 1990s with the introduction of electronic trading and has rapidly grown in popularity ever since.

The development of HFT has been driven by the continuous advancements in technology, specifically the rapid growth of computer processing power and the increase in network speeds. These technological innovations have allowed for faster data analysis and order execution, making HFT a viable trading strategy.

Impact of High-Frequency Trading on Markets

HFT has had a significant impact on financial markets around the world. One of its main contributions is the increase in market liquidity, which refers to the ease of buying and selling assets without causing significant price changes. With HFT, trades can be executed at incredibly high speeds, increasing the number of orders in the market and improving liquidity.

However, there are also concerns about HFT's impact on market stability and fairness. The lightning-fast execution of trades can lead to sudden price fluctuations, which may potentially disrupt the market and create volatility. Additionally, some argue that HFT gives an unfair advantage to those with access to high-speed technology and advanced algorithms, creating a potential disadvantage for smaller investors.

How High-Frequency Trading Works?

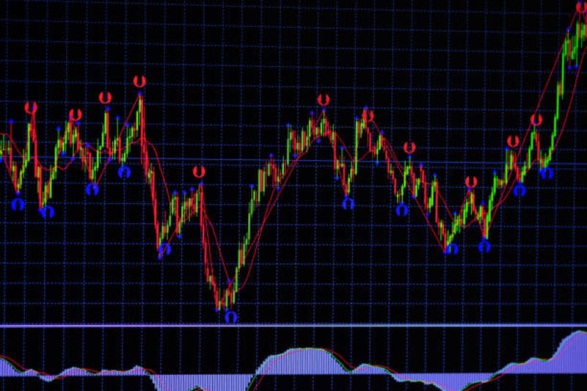

HFT relies on complex algorithms and high-speed technology to analyze market data, identify trading opportunities, and execute trades within milliseconds. These algorithms use a variety of strategies, including statistical arbitrage, trend following, and market-making, to generate profits.

To execute trades at such high speeds, HFT firms typically co-locate their servers in close proximity to the exchange's servers, reducing network latency and allowing for faster order execution. They also use advanced data feeds to receive market information in real-time, giving them a competitive edge over other traders.

Controversies Surrounding High-Frequency Trading

HFT has been met with mixed reactions from the financial community, with some praising its contributions to market efficiency and others criticizing its potential negative impact. One of the main controversies surrounding HFT is the practice of "spoofing," where traders place and quickly cancel large orders to manipulate prices.

Another concern is the potential for market crashes caused by a malfunction or error in HFT algorithms. In 2010, the infamous "Flash Crash" occurred when an algorithmic trading system sparked a massive sell-off, causing the Dow Jones Industrial Average to drop by nearly 1,000 points in a matter of minutes.

Types of High-Frequency Trading

There are various types of HFT strategies used by traders, each with its own unique approach and objectives. Some common types include:

- Statistical Arbitrage: This strategy involves identifying statistical relationships between securities and taking advantage of pricing discrepancies.

- Trend Following: As the name suggests, this strategy involves following market trends and making trades based on the direction of the trend.

- Market-Making: Market makers provide liquidity to the market by constantly buying and selling assets, profiting from the difference between bid and ask prices.

- Event-Driven Trading: This strategy focuses on trading around significant events, such as earnings announcements or economic data releases, that can cause price movements.

Examples of High-Frequency Trading

One example of HFT in action is the use of "co-location" services, where traders pay to place their servers in close proximity to the exchange's servers. This allows for faster order execution and can give an advantage over other market participants.

Another example is the practice of statistical arbitrage, where traders use algorithms to identify pricing discrepancies between two related securities and exploit them for profit. This strategy has become increasingly popular in recent years, with many HFT firms specializing in this type of trading.

The Future of High-Frequency Trading

As technology continues to advance, it is likely that HFT will become even more prevalent in financial markets. Some experts predict that eventually, all trading activity may be completely automated through algorithms, eliminating the need for human traders.

Regulators are also closely monitoring the impact of HFT on markets and implementing measures to prevent potential abuses. As a result, it is possible that there may be stricter regulations or limits placed on HFT in the future. Overall, the evolution of high-frequency trading has revolutionized the financial industry and continues to shape how markets operate. While it remains a controversial practice, its impact on market efficiency and liquidity cannot be ignored. So, it is essential for all market participants to have an understanding of HFT and its implications for the future of trading.

Conclusion

High-frequency trading has been a game-changer in the financial world, leveraging technology to execute trades at unprecedented speeds and volumes. While it has its benefits in terms of market liquidity and efficiency, there are also concerns about its potential negative impact on market stability and fairness. As such, it is crucial for regulators to closely monitor HFT activity and for traders to understand the risks and implications of this trading strategy. With HFT here to stay, it will continue to play a significant role in shaping the future of financial markets. So, staying informed about developments in this area is essential for all market participants.